This detailed Tokenomics model serves as the backbone of the Qublis network, providing stability, growth, and security in the world of decentralized finance, quantum computing, and beyond.

Qublis Tokenomics is designed to ensure long-term sustainability and adaptability in the ever-evolving decentralized ecosystem. By offering utility across a range of use cases, including governance, DeFi, staking, and payments, Qublis’ native tokens provide a powerful and flexible economy for its users. With the flexibility of QUSD, the deflationary mechanism of QBL, and the utility of QPAY, Qublis is positioned to be a key player in the next-generation blockchain economy.

Qublis Tokenomics

Introduction

Qublis is an advanced quantum-resistant decentralized ecosystem powered by innovative tokenomics that enables a diverse range of economic activities, including staking, trading, decentralized finance (DeFi), governance, and more. The foundation of Qublis’ economy lies in the QBL (Qublis Base Layer) token, which serves as the primary currency within the ecosystem.

Key Tokens in Qublis Ecosystem

-

QBL (Qublis Base Layer Token)

-

Role: The primary native token of the Qublis blockchain.

-

Utility: Used for transaction fees, staking, DeFi activities, governance, and network operations.

-

Total Supply: 1,000,000,000 QBL (Fixed Supply)

-

-

QUSD (Qublis Stable Dollar)

-

Role: A stablecoin pegged to the value of USD, used for transactions, savings, and store of value within the Qublis ecosystem.

-

Utility: Facilitates low-volatility trades, lending, borrowing, and collateralized smart contracts.

-

Total Supply: Supply is dynamically adjusted to maintain the peg with USD through a decentralized collateral management system.

-

-

QPAY (Qublis Payment Token)

-

Role: A utility token used for daily transactions within the ecosystem.

-

Utility: Facilitates quick, low-cost payments for goods, services, and platform fees.

-

Total Supply: Dynamic supply based on demand and transaction volume.

-

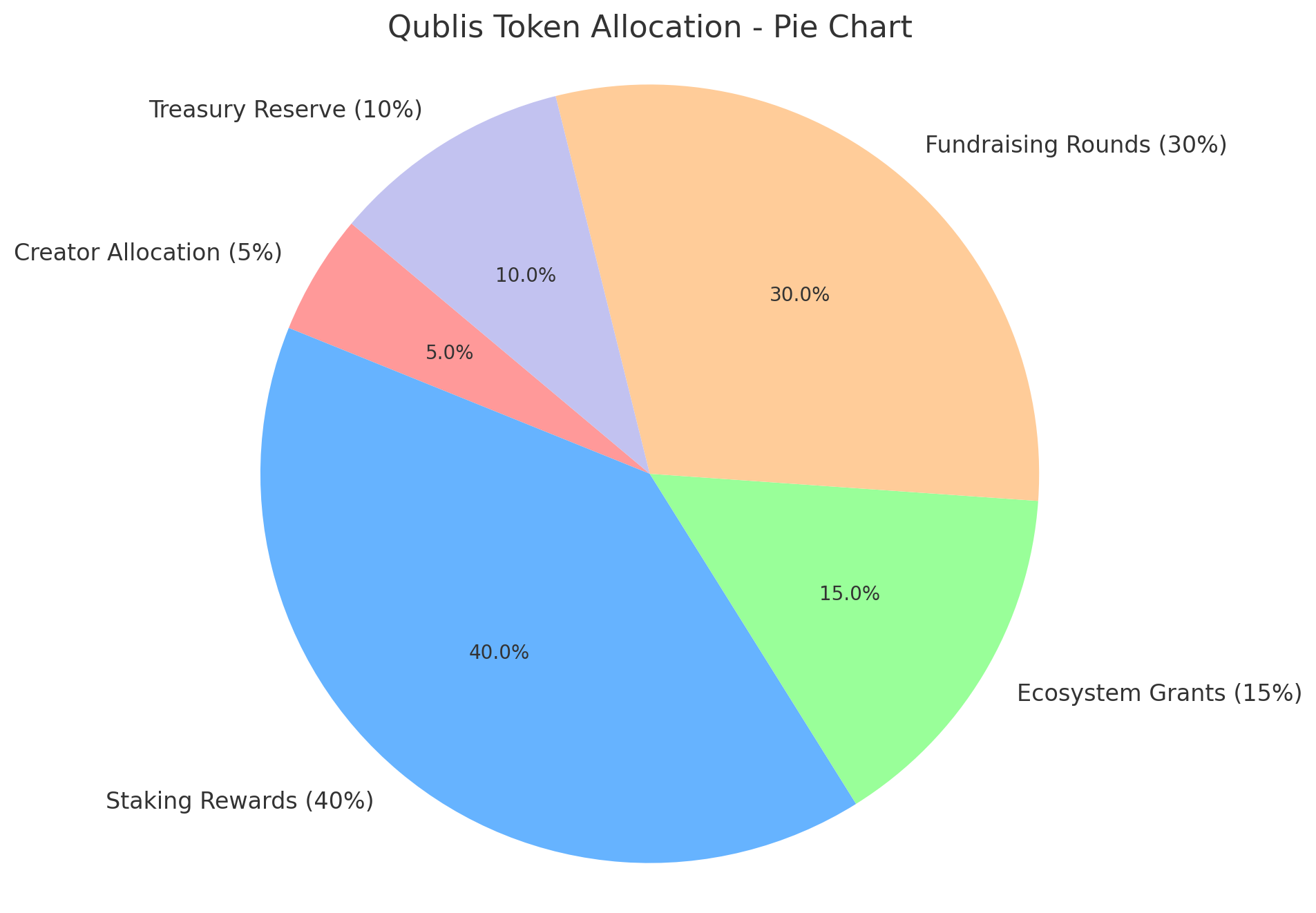

Token Distribution

The token distribution of QBL, QUSD, and QPAY is designed to incentivize growth, decentralization, and long-term sustainability of the ecosystem.

| Token | Allocation | Details |

|---|---|---|

| QBL | 60% (600,000,000) | A significant portion is reserved for staking, validator rewards, and liquidity incentives. |

| QUSD | 20% (200,000,000) | Stablecoin liquidity and collateral backing for decentralized finance applications. |

| QPAY | 10% (100,000,000) | Distributed for platform fees, payments, and reward incentives. |

| Team & Development | 5% (50,000,000) | Allocated to the Qublis core development team, distributed over 5 years. |

| Governance & Reserve | 5% (50,000,000) | Reserved for governance participation, ecosystem expansion, and unexpected needs. |

Utility and Use Cases of QBL Token

-

Staking and Rewards:

-

Token holders can stake their QBL tokens to support the network and earn rewards in QBL, QUSD, and QPAY.

-

Staking rewards are distributed based on the amount of QBL staked and the duration of the stake.

-

-

Governance:

-

QBL token holders have voting power in Qublis’ decentralized autonomous organization (DAO).

-

Voting rights are used for protocol upgrades, project proposals, and economic decisions (e.g., inflation rate of QUSD, reward distributions).

-

-

Transaction Fees:

-

QBL is used to pay for transaction fees on the Qublis blockchain.

-

Transaction fees are dynamically adjusted based on network load.

-

-

DeFi and DEX:

-

QBL is used as collateral in decentralized finance applications like lending, borrowing, and liquidity provision.

-

Through decentralized exchanges (DEX), users can trade QBL for other tokens, including QUSD and QPAY, enabling a seamless exchange of value within the ecosystem.

-

Economic Model

-

Inflationary and Deflationary Mechanisms:

-

Staking Rewards: A small amount of newly minted QBL is distributed as staking rewards.

-

Deflationary Pressure: Transaction fees and burned tokens from QBL are permanently removed from circulation, reducing supply over time.

-

Governance Adjustments: Inflation and deflation can be adjusted through governance voting by QBL holders to balance the economic health of the ecosystem.

-

-

Elastic Stablecoin Model (QUSD):

-

QUSD Pegging: QUSD is pegged to the USD using a decentralized collateral management system to ensure stability.

-

Supply Adjustments: The supply of QUSD is elastic, adjusted automatically to match the collateral pool and maintain the peg.

-

Economic Incentives

-

Liquidity Mining:

-

QBL token holders can provide liquidity to Qublis decentralized exchanges and earn fees and additional token rewards.

-

-

Validator Rewards:

-

Validators who secure the network by producing blocks are rewarded with QBL and transaction fees, ensuring a decentralized and secure network.

-

-

Node Operation:

-

Operators of Qublis full nodes are incentivized with rewards in QBL, ensuring that the network remains decentralized, secure, and robust.

-

Qublis Tokenomics Impact

-

Security: By integrating staking rewards, validator incentives, and governance participation, Qublis ensures that all stakeholders are incentivized to maintain the integrity of the network.

-

Stability: QUSD’s stable peg to the US Dollar and QBL’s deflationary burn mechanisms protect the network from the volatility typically seen in many crypto ecosystems.

-

Decentralization: The distribution of QBL and QUSD tokens across staking, governance, and liquidity pools ensures that the Qublis ecosystem remains truly decentralized, with no single entity controlling the protocol’s future.

-

Growth: Through incentivized staking, liquidity mining, and governance participation, Qublis fosters long-term growth in both its user base and its ecosystem of decentralized applications (dApps).